In The Outsourcing Decision,1 author Ralph E. Drtina demonstrates that in a globally competitive economy the prospect of outsourcing is increasingly relevant in management accounting. He also suggests that there are deficiencies in how most accounting professionals and academics evaluate the opportunity cost of hiring an external firm to acquire internally controlled activities.

Rather than leave us with a broad critique of existing methods, Drtina recommends a straightforward methodology by which managers can make better decisions.

Evaluating Options

Drtina presents an example where maintenance for the delivery fleet of a manufacturing company is considered for outsourcing. Initially, he suggests a firm must determine the importance of controls for the service, especially when considering confidential documents or proprietary technology, and whether the firm considering outsourcing can deliver the service to the highest standards in-house.

On the latter point, Drtina adds, “A determination must be made whether the firm can achieve a world-class level of delivery. If it is not possible to accomplish benchmarked standards of performance, the activity should be outsourced. To reiterate, the firm should concentrate only on those core activities that enhance its unique marketplace advantages.”

Long-term Planning

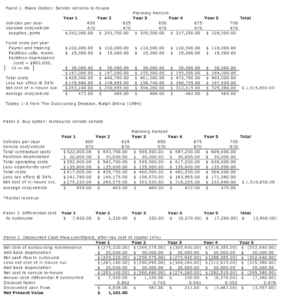

Ultimately he contrasts two cost analyses and shows the need for additional accounting information to assist decision-makers. In the first example (see Panel 1, below) Drtina presents a typical five-year planning sheet to determine a straightforward differential cost to outsourcing.

He does this by subtracting the net cost of servicing vehicles in-house by the net cost of outsourcing vehicle maintenance. The number of vehicles increases by 25 per year and training increases accordingly over time by growth estimates. In year 1, the differential cost to outsource is seen as $7,920 in favour of outsourcing.

As is seen in the table however, efficiencies in operations in-house begin to emerge by year 4 and the differential cost to outsource shifts with it resulting in a negative figure by year 4 of -$6,270 and by year 5, the cumulative differential over the period is -$3,960.

By estimates using this method, the clear decision would be to maintain the fleet maintenance service internally.

Innovation

Not satisfied with this approach, Drtina decides to apply a figure, which takes into consideration the time value of invested capital (see Panel 2, below). Drtina discounts the cash flows by 16% and finds that the net present value for the 5 years is in fact positive, at $1,101 (see also Panel 3, below).

At the end of the day it is likely more useful to apply his methodology, however, decision-makers at all levels may need support and education to see the value in what he proposes. Management accounting as a discipline is extremely important, and yet, not for the faint-of-heart.

Panels 1-3: Based on Drtina’s work in “The Outsourcing Decision”

Conclusions

Drtina appears to be influenced by his own philosophy around outsourcing and not strictly by his numbers. For example, he says, “Before making a final decision… management must consider the less tangible, more uncertain benefits… These qualitative factors may prove significant and may take precedence over results favored in the discounted cash-flow analysis.”

This does not suggest that he has misunderstood the influence or lack of influence in his accounting innovation. Rather, it shows that the forward-thinking managerial accountant must take into consideration more than the short-term data we have on hand, and certainly more than quantitative data alone.

[1] Ralph E. Drtina. (1994). The Outsourcing Decision. Management Accounting, 56-62. McGraw-Hill Education.